FinanceFlow

The design and development of a full-stack FinTech application powered by a predictive AI engine.

You're currently viewing the executive summary case study. Looking for a detailed design process? View it here.

Context

My journey with personal finance tracking started out of necessity. Back in 2006, when I moved to São Carlos for college, my father asked me to send him a monthly spreadsheet detailing all my expenses so he could manage my allowance. This simple habit stuck with me. For nearly two decades, I meticulously filled out spreadsheets, month after month, year after year.

This long-standing personal "itch" was the spark for FinanceFlow. As they say, "scratch your own itch." With the rise of AI and no-code platforms, I saw an opportunity to finally build the solution I had always wanted: an AI-powered personal finance web app.

I took on the role of AI Developer & Product Designer. I started the project on June 2025 (and it's ongoing as I implement new features) with the mission to transform this personal solution into a robust platform that could help anyone gain control of their financial life.

The Problem

My personal experience with spreadsheets was a strong starting point, but I needed to validate it with real data. The quantitative research confirmed that financial fragmentation was a widespread issue. The survey of 150 users revealed that 69% manage two or more financial platforms (banks, credit cards, etc.), and a significant 39% still relied on manual spreadsheets to keep track of it all.

This complexity led to tangible, recurring pain points. The data was clear:

63% of users struggled with spending more than they planned.

59% felt a lack of vision about "where their money went."

54% admitted to forgetting to pay bills or invoices.

As one user from our in-depth interviews put it, "I feel like I'm flying blind with my money. I know it's coming in and going out, but I don't know where or why." The core problem was a lack of a consolidated, clear view, which left users feeling reactive and out of control.

The Business Need

The research data immediately highlighted a major business opportunity. The high reliance on manual methods and the clear user frustrations signaled a deeply underserved market. This wasn't just a minor inconvenience; it was a source of stress and costly financial missteps.

72%

Everything in one place

54%

Lack of secutiry

46%

Confusing interface

The demand for a solution was overwhelming: 72% of surveyed users stated that "viewing everything in one place" was the single most important feature they wanted in a finance app. Furthermore, with 54% citing "lack of security" and 46% citing a "confusing interface" as primary reasons they would not adopt a new tool, the business need was twofold:

Build a platform that delivers the unified view users desperately want.

Do it with a simple, intuitive design and transparent security to overcome key adoption barriers.

By addressing this clear market gap, we could capture a large user base, drive strong acquisition, and build a product with high retention value.

The Solution

My solution was to design a centralized, intuitive, and forward-looking dashboard that puts the user back in control. Based on the user research, the focus was on three core pillars:

Comprehensive Overview

Detailed Transaction Management

Clear Net Worth Tracking

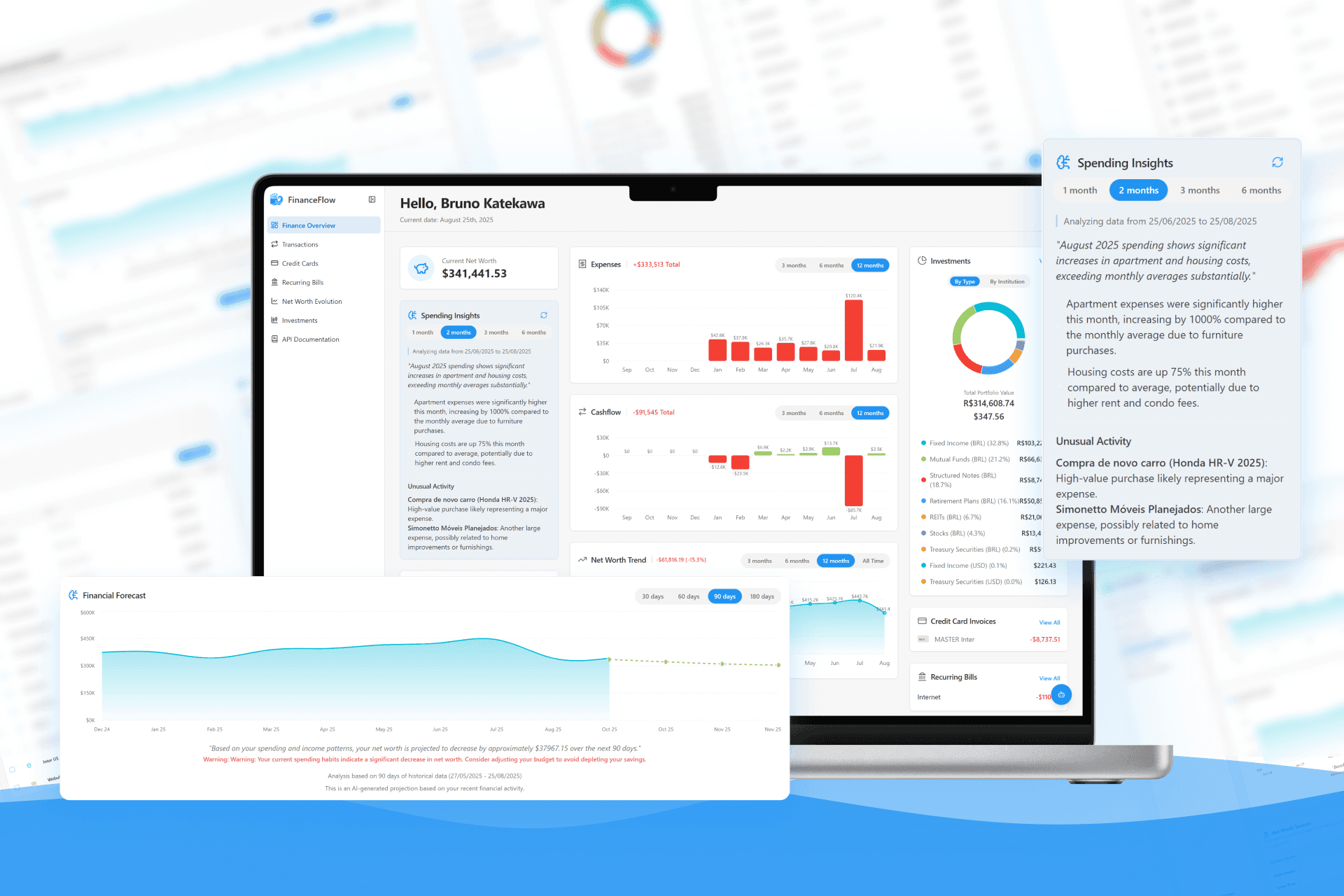

The journey begins at the main dashboard, which serves as the financial command center. It immediately provides a high-level summary of the most critical information— AI-Powered spending insights, cash flow, and investment performance—so users can get a quick health check without digging through multiple pages.

To address the question, "Where did my money go?", I designed a dedicated transactions page. Here, users can see a clear list of all their incomings and expenses. I added a summary of total cash flow for the month and a visual breakdown of expenses by category. This helps users instantly identify where they can cut back and make more informed spending decisions.

Finally, to help users track their long-term goals, I created the "Net Worth Evolution" screen. This was more than just a number; it was about showing progress. The main chart visualizes their net worth growth over time, providing a sense of accomplishment. We also incorporated an AI-generated forecast to help them plan for the future and allowed them to add and update all their asset sources in one place, from bank accounts to crypto wallets.

Key Takeaways and Lessons Learned

The final design successfully provides a holistic and empowering financial overview, directly addressing the fragmentation and lack of clarity our users faced. By consolidating all financial data into one place and providing actionable insights, FinanceFlow helps users move from feeling overwhelmed to feeling in control.

Throughout this project, I had several key learnings:

Clarity Over Complexity

In finance, it's easy to overwhelm users with data. My biggest challenge was balancing information density with a clean, intuitive interface. We learned that users valued a clear, high-level summary on the dashboard far more than seeing every single detail at once.

The Power of Proactive Insights

Simply displaying data isn't enough. Features like the AI-powered "Spending Insights" and the "Financial Forecast" were game-changers. Users don't just want to see their history; they want guidance on what might happen next and what they should pay attention to.

Design for Real-Life Scenarios

People's financial lives are messy. Allowing users to add custom sources like "Primary Residence" or manually adjust values was crucial. Acknowledging that not everything can be automated made the tool more flexible and trustworthy for users like Maria, who have complex financial situations.

Translate AI output into a user-centric experience

My primary lesson was that real value comes not from just detecting an anomaly, but from presenting that insight with context and clarity. Translating raw AI output into something meaningful requires designing with deep user empathy.

A successful AI feature is built on a strong data foundation

A key technical challenge was structuring data and prompts to ensure the AI's analysis was consistently accurate and relevant. This proved that a great AI user experience depends as much on thoughtful data engineering as it does on the interface design itself.

Embrace a holistic, end-to-end approach

Managing this project from the initial concept to the final AI integration reinforced how every decision, technical or strategic, directly impacts the user experience. This holistic view was essential for creating a cohesive and truly useful product.